Lyon

Descriptif

Acquisition en 2019, en VEFA auprès de Nexity, le futur siège lyonnais du promoteur.

L’immeuble, qui totalise 13 300 m² surface de plancher et 370 places de parking en infrastructure, sera livré en début 2022 et est préloué à près 66 %.

Caractéristiques

- Surface de 13 300m² de bureaux

- Livraison 2022

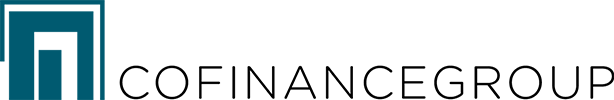

New York – Manhattan – East Village

Description

Cofinance acquired 302 East 12th Street in the East Village of Manhattan in late 2018.

The building has undergone a meticulous head-to-toe renovation and these brand-new apartments offer the perfect combination of prewar charm and modern luxury.

Property summary

- Surface 4 560 ft²

- Year of acquisition: 2018

Cachan

Descriptif

En 2018, Cofinance lance en blanc la construction d’un immeuble de bureaux et commerces de 4 500 m², situé à Cachan.

Acquis dans le cadre d’une vente en l’état futur d’achèvement, l’actif fait partie d’un programme mixte développé par BPD Marignan, qui comprend également un immeuble résidentiel offrant 45 appartements à l’accession.

Ce projet, situé à proximité immédiate de la gare RER B et future gare de connexion avec la ligne 15 du métro, illustre la volonté de Cofinance d’être un acteur dynamique du renouveau du parc tertiaire autour des gares du Grand Paris.

Caractéristiques

- Bureaux et commerces

- Surface de 4 500 m²

- Livraison 2020

- L’ouvrage sera certifié RT 2012 – 10% / NF HQE® Bâtiments Tertiaires

New York – Manhattan – East Village

Descriptif

Acquisition en mai 2019 d’un immeuble de bureau à New York (Manhattan – East Village)

Surface totale de 18 326 ft²

Actif loué à The Wing, bail ferme de 7 ans

Caractéristiques

- Bureaux

- Surface de 1 700m²

Roissy Charles de Gaulle

Descriptif

Développement clé-en-mains de l’extension de Hub Européen de Fedex en zone sous douane à Roissy, en partenariat avec le Groupe ESSOR.

En 2017, signatures d’un bail en l’état futur d’achèvement d’une durée de 30 ans avec Fedex et d’un bail à construction avec Aéroports de Paris.

Caractéristiques

- Surface de 48 700m² destinée à accueillir

un système innovant de tri des colis - Livraison 2019

Trouville sur Mer

Descriptif

Acquisition dans le cadre d’un bail à construction de 80 ans de l’hôtel des Cures Marines à Trouville-sur-mer. Cet immeuble, monument historique abandonné depuis 1999, a fait l’objet de lourds travaux de rénovation qui ont permis de livrer un hôtel/thalasso de 5 étoiles exploité sous l’enseigne MGallery.

Le groupe COFINANCE est propriétaire des murs et du fonds de cet hôtel.

Caractéristiques

- Surface de 11 000 m²

- Hôtel 5 étoiles – Thalasso Spa – Restaurant 1*

- Rénovation lourde d’un bâtiment historique (2010-2014)

- Contrat de management Accor, sous la marque Mgallery

- 103 chambres + restaurant

- 400 m² de salles de conférence

- 35 cabines de soin thalasso

- 80 parkings

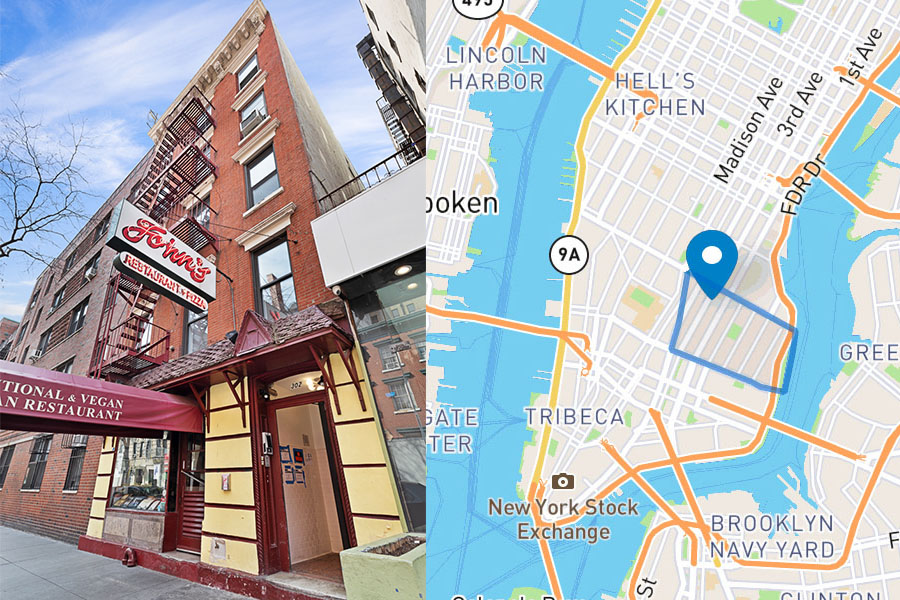

Paris – Montmartre

Descriptif

Acquisition en 2014 d’une parcelle de 120 mètres de long en vue de la redévelopper et de créer une voie privée dans Paris.

Ensemble de bâtiments résidentiels et de commerce de pied d’immeuble dont le Théâtre des 2 Ânes.

Livraison en 2018 de 6 000 m² environ de superbes lofts avec verrières, terrasses et jardins privatifs.

Caractéristiques

- Surface de 6 000 m²

- Destination mixte : résidentiel, commerce, bureaux

- Projet d’une valeur de 50 M €

New York, NY

Descriptif

En 2005, Cofinance Inc. fait l’acquisition d’un immeuble de bureau édifié en 1927, rénové en 1981 et d’une surface de 74,000 pieds carrés dans la ville de New York à proximité immédiate de Colombus Circle et du Lincoln Center. L’immeuble est loué par la municipalité et occupé par une école. Le loyer (NNN) est de $3,3 million par an.

Caractéristiques

- Surface de 6 880 m²

- The Air Rights sont rattachés à l’immeuble

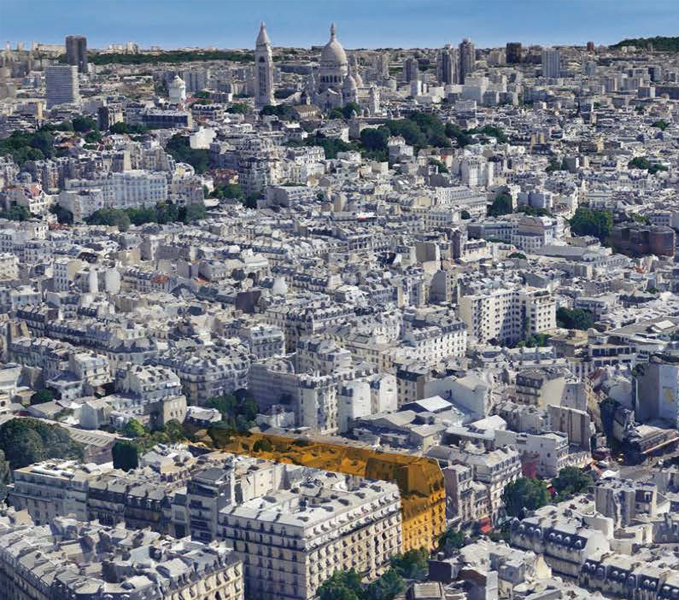

Los Angeles, CA

Descriptif

Cofinance Inc. a acquis en 1992 un ensemble de parcelles à proximité de l’aéroport de Los Angeles (CA). La stratégie de l’investisement est basée sur la mise en location du foncier auprès de locataires exploitant sur des durées longues (30 à 90 ans): hotel, parking, bureau. L’ensemble immobilier sous-jacent développe une surface totale de 556,000 pieds carrés.

Caractéristiques

- Surface totale de 51 650 m²

- Destination mixte : hôtel, bureau, parking

Villeurbanne, Rhône

Descriptif

Acquisition en 2017 d’un immeuble emblématique devenu le pôle tertiaire audiovisuel de l’agglomération lyonnaise et bénéficiant d’un emplacement privilégié à moins de 15 minutes de la Part-Dieu avec un accès direct en tramway.

Ensemble de 6 bâtiments livré en 2009 à usage de bureaux, studio de cinéma et restaurant développant une surface locative totale de 12 000 m² environ.

Caractéristiques

- Surface de 12 191m²

- Destination mixte bureaux, studio de cinéma et restaurant